Key Takeaways

- Pet insurance can significantly reduce out-of-pocket veterinary expenses, especially in emergencies.

- It provides access to a wider range of treatment options without financial stress.

- Helps in budgeting for pet care by spreading out costs over time.

- Costs and exclusions can be a drawback; not all health issues are covered.

- Pet insurance can impact your lifestyle positively, making activities like gardening and visiting dog parks safer and more enjoyable.

Understanding the Pros and Cons of Pet Insurance

Pet insurance can be a lifesaver for many pet owners. Understanding its pros and cons helps you make an informed decision. Let’s delve into the specifics to see if it’s the right choice for you and your furry friend.

“Pros and cons of getting cat insurance …” from www.petscreening.com and used with no modifications.

Saves You Money on Vet Bills

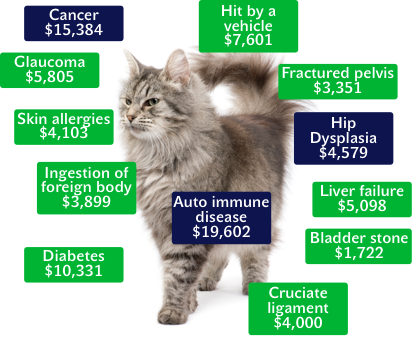

One of the most compelling reasons to get pet insurance is the potential savings on veterinary bills. If your pet suddenly falls ill or gets injured, the costs can be astronomical.

“Veterinary bills can add up quickly if your dog or cat requires surgery or extensive medical treatment.”

For example, a simple surgery can cost upwards of $2,000. With pet insurance, a significant portion of this cost can be covered, easing your financial burden.

Access to More Treatment Options

Having pet insurance can open up a wider range of treatment options. Without the stress of high costs, you might consider treatments that you otherwise couldn’t afford.

For instance, advanced treatments like chemotherapy for pets with cancer can be prohibitively expensive. Insurance can help cover these costs, providing your pet with the best possible care.

Helps Budget for Pet Care

Another advantage of pet insurance is that it helps you budget for pet care. Instead of facing a massive bill all at once, you can pay a monthly or annual premium.

- Monthly premiums can range from $20 to $50 for dogs.

- Cats are generally cheaper, with premiums ranging from $10 to $30.

By spreading out the cost, you can manage your finances more effectively, ensuring that your pet gets the care they need without breaking the bank.

Potential Drawbacks of Pet Insurance

While there are numerous benefits to pet insurance, it’s essential to consider the potential drawbacks as well.

Costs and Premiums

One of the main downsides is the cost. Premiums can add up over time, and if your pet remains healthy, you might feel like you’re paying for something you don’t use. For those considering other pet-related expenses, learning how to socialize your adult rescue dog might be a beneficial investment.

Additionally, the cost of premiums can increase as your pet ages or if they belong to a breed prone to health issues.

Exclusion Clauses

Most importantly, not all health issues are covered by pet insurance. Pre-existing conditions are often excluded, and some policies might not cover hereditary or congenital conditions.

It’s crucial to read the fine print of any policy to understand what is and isn’t covered. This way, you won’t be caught off guard when you need to make a claim.

Upfront Payments and Reimbursements

With most pet insurance policies, you’ll need to pay for the veterinary services upfront and then file a claim for reimbursement. This means you still need to have the funds available initially.

While this system works for many, it can be a hurdle if you’re facing a particularly large bill and don’t have the cash on hand.

Is Pet Insurance Necessary?

Deciding whether pet insurance is necessary can be a tough call. Each pet owner’s situation is unique, and what works for one may not work for another. However, there are several factors to weigh that can help you make an informed decision.

One of the main things to consider is the cost of veterinary care. Veterinary expenses can range from routine check-ups to emergency surgeries, and the costs can add up quickly. If you’re worried about the financial burden of unexpected vet bills, pet insurance can offer peace of mind.

“Given all of this, pet insurance may be worth it for many pet owners. Situations where it may not be worth it for you include if your pet is older or already has health problems or if you could easily afford an expensive veterinary bill.”

Factors to Consider

When deciding on pet insurance, consider the following factors:

- Age of Your Pet: Younger pets generally have fewer health issues, but as they age, the likelihood of needing medical care increases.

- Breed-Specific Health Issues: Some breeds are more prone to certain health conditions. Research your pet’s breed to understand potential risks.

- Existing Health Conditions: Pre-existing conditions are typically not covered by pet insurance. If your pet already has health issues, it may affect the coverage you can get.

Risk Assessment

Assessing the risk factors for your pet is crucial. Ask yourself questions like:

- Is my pet adventurous and likely to get into accidents?

- Does my pet have a history of health issues?

- Do I live in an area with risks such as ticks or other pests?

Understanding these risks can help you determine if pet insurance is a good fit for your situation. If your pet is prone to accidents or has a history of health problems, insurance might be a wise investment. Additionally, knowing whether certain plants or trees, like bottlebrush trees, are safe for your pets can also be crucial for their overall well-being.

Personal Financial Situation

Your financial situation plays a significant role in this decision. Consider whether you have the financial cushion to cover unexpected veterinary expenses. If a large vet bill would strain your finances, pet insurance can offer a safety net.

On the other hand, if you have ample savings and can comfortably handle unexpected costs, you might decide that pet insurance isn’t necessary. Ultimately, it’s about balancing peace of mind with financial practicality.

Pet Insurance and Its Impact on Your Lifestyle

Pet insurance doesn’t just affect your wallet; it can also impact your lifestyle in positive ways. Knowing that your pet is covered can make activities like gardening and visiting dog parks more enjoyable and less stressful.

“Pet insurance can eliminate the need to choose between your financial well-being and your pet’s health.”

Gardening with Pets

Gardening with pets can be a delightful experience, but it also comes with risks. Pets can ingest toxic plants, get stung by insects, or suffer from injuries while playing in the garden. Pet insurance can provide coverage for these unexpected incidents, allowing you to enjoy gardening without constant worry.

Going to Dog Parks

Dog parks are a great way for your pet to socialize and exercise, but they also pose risks such as injuries from rough play or exposure to diseases. Pet insurance can cover the medical costs associated with these incidents, making trips to the dog park less stressful and more fun for both you and your pet.

In conclusion, while pet insurance comes with its costs and limitations, the peace of mind and financial protection it offers can be invaluable. By understanding the pros and cons, and considering your pet’s specific needs and your financial situation, you can make an informed decision that best suits you and your furry friend.

Bottom Line

In summary, pet insurance offers numerous benefits, including financial protection against unexpected veterinary bills and access to a wider range of treatment options. However, it also comes with its own set of drawbacks, such as costs and exclusions. Whether pet insurance is necessary depends on various factors, including your pet’s age, breed, and your financial situation. By carefully weighing the pros and cons, you can make an informed decision that best suits you and your pet.

Pet insurance can also positively impact your lifestyle, making activities like gardening and visiting dog parks safer and more enjoyable. The peace of mind that comes with knowing your pet is covered can enhance your overall experience as a pet owner. For instance, knowing which plants are safe or toxic for cats and dogs can help you create a pet-friendly garden.

- Pet insurance can save you money on unexpected vet bills.

- It provides access to more treatment options without financial stress.

- Helps in budgeting for pet care by spreading out costs over time.

- Costs and exclusions can be a drawback; not all health issues are covered.

- Pet insurance can make activities like gardening and visiting dog parks safer and more enjoyable.

Ultimately, the decision to get pet insurance should be based on a thorough evaluation of your pet’s needs and your financial capabilities. By doing so, you can ensure that your furry friend receives the best possible care without compromising your financial well-being.

Summary of Key Points

Pet insurance can be a valuable tool for managing unexpected veterinary expenses and providing peace of mind. However, it’s essential to understand the costs, exclusions, and potential drawbacks before making a decision. By considering factors such as your pet’s age, breed, and your financial situation, you can determine whether pet insurance is the right choice for you and your pet. Additionally, pet insurance can positively impact your lifestyle, making activities like gardening and visiting dog parks safer and more enjoyable.

Frequently Asked Questions (FAQs)

Here are some common questions pet owners have about pet insurance:

What does pet insurance typically cover?

Pet insurance typically covers a range of veterinary expenses, including accidents, illnesses, surgeries, and emergency care. Some policies also offer coverage for routine care, such as vaccinations and wellness exams, but this often comes as an optional add-on. It’s important to read the policy details to understand what is and isn’t covered. For example, some policies may not cover treatments for pet-safe plants if ingested.

Are older pets eligible for pet insurance?

Yes, older pets are eligible for pet insurance, but the premiums are usually higher, and there may be more exclusions, especially for pre-existing conditions. Some insurers have age limits for new policies, so it’s best to get coverage while your pet is still young.

However, if your older pet is healthy, you may still find a policy that provides valuable coverage for unexpected illnesses and injuries.

Can I use my pet insurance with any vet?

Most pet insurance policies do not have healthcare networks, meaning you can use your insurance with any licensed veterinarian. This flexibility allows you to choose the best care for your pet without worrying about network restrictions.

How do I file a claim with my pet insurance?

Filing a claim with your pet insurance is usually a straightforward process. Here are the general steps:

First, gather all necessary documentation, such as your pet’s medical records and receipts. Then, complete the claim form provided by your insurance company. It’s important to ensure all details are accurate to avoid delays. Finally, submit the claim form along with the required documents either online or by mail. For more information on taking care of your pet, you can read about socializing your adult rescue dog.

- Pay for the veterinary services upfront.

- Collect all necessary documentation, including invoices and medical records.

- Submit the claim form and documentation to your insurance provider.

- Wait for the reimbursement, which can take anywhere from a few days to a few weeks, depending on the provider.

Each insurance company may have slightly different procedures, so it’s essential to read the instructions provided by your insurer.